By 2028, Bitcoin will undergo its next halving, slashing miner rewards from 3.125 to 1.5625 BTC per block. Meanwhile, major players like Strategy already control 2.8% of the total supply, and proposed legislation could put another 5% in U.S. government hands. With institutional adoption accelerating and only 164,250 new bitcoins minted annually until 2028, we're witnessing the beginning of a massive supply and demand mismatch.

TLDR: Here are the key points about Bitcoin's supply and price outlook:

- Annual Bitcoin mining rate is 164,250 until April 2028, when it halves to 82,125.

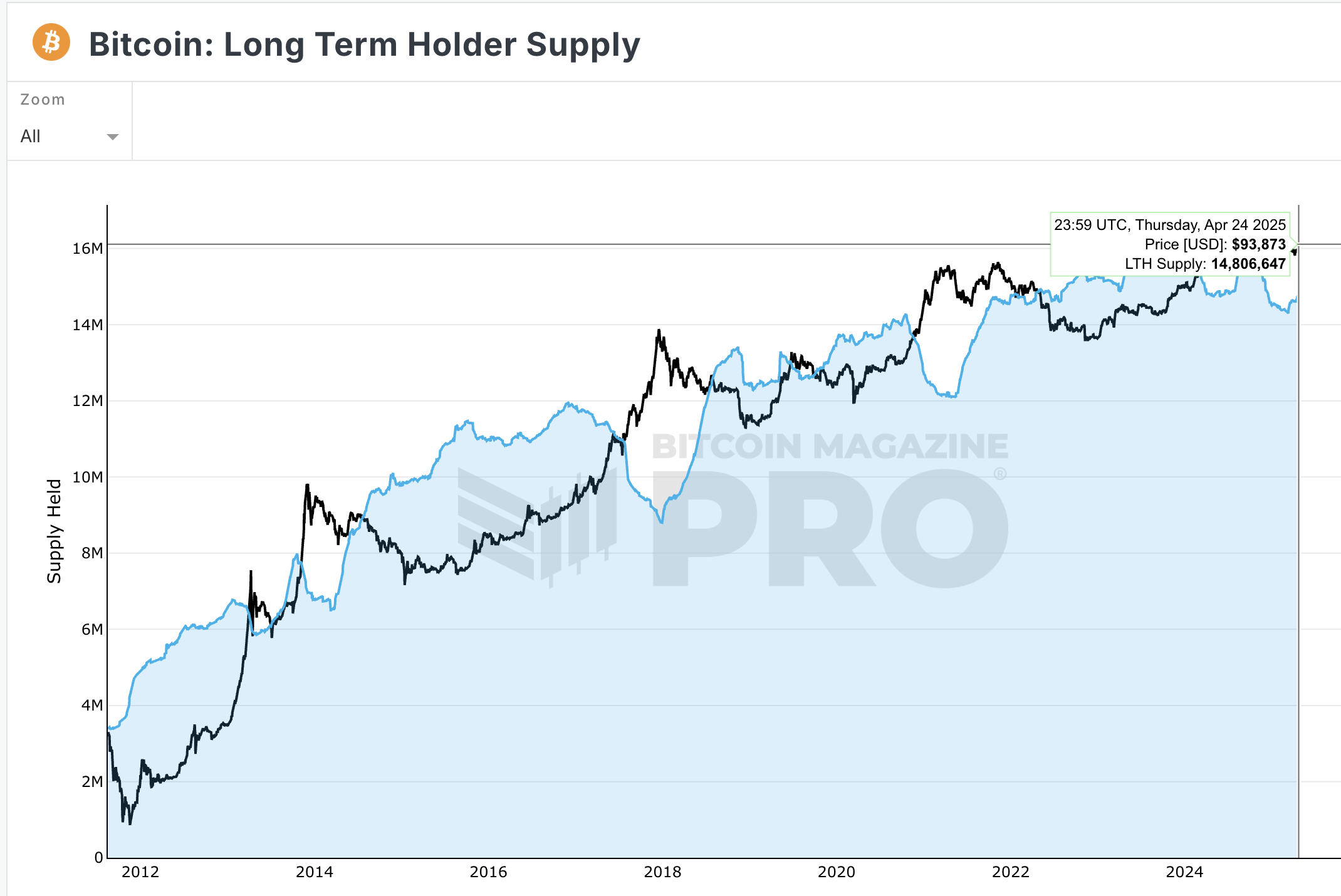

- Current circulating supply is 19.85M Bitcoin, with about 14.8M held by long-term holders.

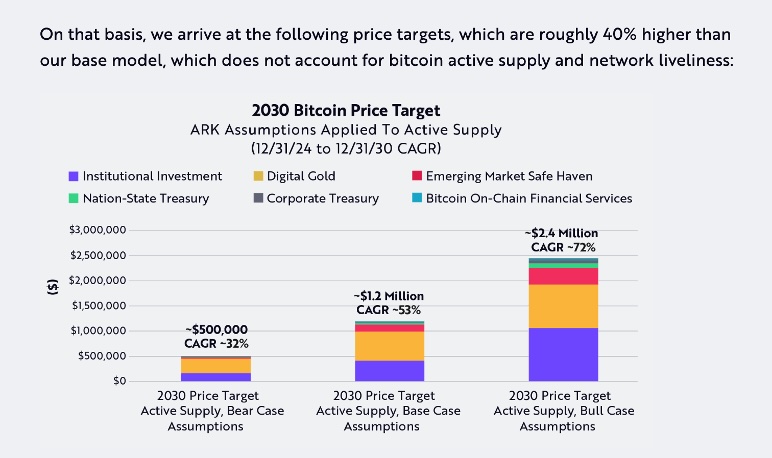

- Ark Invest's revised 2030 price predictions: Bear case $500K, Base case $1.2M, Bull case $2.4M.

- Strategy currently controls 2.8% of supply, while proposed US legislation could put another 5% under government control.

How much Bitcoin is mined per year in 2025?

On average miners produce 144 Bitcoin blocks per day or about 52,560 blocks per year. The current reward is 3.125 Bitcoin per block so the total estimated annual Bitcoin mined is 164,250. The Bitcoin halving is about three years away, currently estimated for the middle of April 2028 as shown by CoinGecko when the reward drops to 1.5625 Bitcoin per block.

Source: CoinGecko

Source: CoinGecko

Here’s an April-to-April breakdown of annual new Bitcoin supply:

- 2025-2026: 164,250

- 2026-2027: 164,250

- 2027-2027: 164,250

- 2028-2029: 82,125

- 2029-2030: 82,125

Total new supply: 657,000

What is the Bitcoin supply shock?

Our hypothetical 1,148,000 Bitcoin demand for US states through 2030 is 1.75 times higher than the new supply over the same time period. This is only one stakeholder group: the US states, so you can see how supply and demand could lead to a hyperbolic Bitcoin price. More to come on the brewing status of US states Bitcoin reserve bills.

When the demand for Bitcoin is much greater than new supply, then the spillover demand can only be filled by the existing supply. According to Bitcoin Magazine the total long-term holder supply is 14,806, 647 as of April 2025.

Source: Bitcoin Magazine Pro

According to Blockchain.com, the current circulating supply of Bitcoin is 19,855,017 as of April 2025, which leaves a delta of 5,048,370 short-term holders or active supply (19,855,017-14,806,647=5,048,370). This doesn’t account for the estimated millions of lost Bitcoin and other factors so the short-term supply is much less. The short-term supply is the active supply available for demand in bitcoin markets. Further, only some of the short-term supply holders are willing to sell at any point in time. The total active supply is not “available for sale” on any given day.

Source: Blockchain.com

What is Ark Invest’s bear, base and bull case for Bitcoin in 2030?

ARK’s Big Ideas 2025 report includes updated bitcoin price targets for 2030, with bear, base, and bull cases of ~$300,000,~$710,000, and ~$1.5 million per bitcoin, respectively. This are similar to the price projections in Ark’s 2023 and 2024 reports so they have been very consistent for several years.

The previous methodology did not account for liquid or active supply. Their latest revised 2030 Bitcoin price target incorporated active supply resulting in a much larger price. According to Ark, “…Bitcoin’s network liveliness has remained near ~60% since early 2018. In our view, that magnitude of liveliness suggests that ~40% of supply is “vaulted…” Ark’s calculation of active supply is much higher than our calculation above.

Key Takeaway

A supply shock analysis would not be complete without considering active supply. Lost coins and long-term holders must be subtracted from total supply to arrive at active supply.

What is Ark Invest’s revised Bitcoin 2030 price prediction?

After factoring in active supply, Ark’s new price predictions from their Bitcoin analysis in Big Ideas 2025 is astonishingly higher than the previous prediction.

Ark’s 2025 Big Ideas Report: (base methodology no active supply considered)

Bitcoin price by 2030:

- Bear $300,000

- Base $710,000

- Bull $1,500,000

Ark’s New Bitcoin price prediction: (active supply considered)

Bitcoin price by 2030:

Bear $500,000

Base $1,200,000

Bull $2,400,000

Source: Ark Invest

How big is the Bitcoin return for the bull case?

The 2030 revised bull case of $2.4M Bitcoin is a 25X return assuming a $96,000 current price. That’s incredible for an asset to be near it’s all time high and still have a 25X upside. The $2.4M bull case is 60% higher than the previous $1.5M bull case and the bear case is 69% higher.

Key Takeaway

Anyone could jump into Bitcoin in April 2025 and still get incredible returns over a 5-year period.

Estimated demand comes from looking at the total addressable market (TAM) and penetration rates across 6 areas.

Ark considers six areas that make up TAM:

- Institutional investment

- Digital gold

- Emerging market safe haven

- Nation-state treasury

- Corporate treasury

- Bitcoin on-chain financial services

The 2030 Bitcoin Price Target chart shows how nation-state treasury, corporate treasury and Bitcoin on-chain financial services are inconsequential relative to the penetration from institutional investment, digital gold and emerging market safe haven addressable markets.

Key Takeaway

Strategy (MSTR), a publicly traded company, has accumulated 553,555 Bitcoin, as of April 2025 which means they control 2.8% of the current circulating supply. (553,555/19,855,017 = 2.8%)

How will corporate treasury demand for Bitcoin change over time?

The TAM for corporate treasuries to 2030 is only $7T compared to the TAM for institutional investment to 2030 of $200T. Even though estimated Bitcoin demand from nation-state treasury, corporate treasury and Bitcoin on-chain financial services is a small piece of overall demand, no subsegment of demand should be underestimated.

Bitwise CIO, Matt Hougan, said, “You have ETFs vacuuming up Bitcoin, you have public companies like Strategy vacuuming up Bitcoin and now we’re talking about governments vacuuming up Bitcoin, at the end of the day it comes down to supply and demand. There is too much demand and not enough supply.” He further elaborated, “If we do get a strategic reserve where the government is buying Bitcoin and there’s a bill from Senator Lumis that has the government buy 1M Bitcoin, $200k Bitcion’s going to be looking quaint, you’re going to be looking at 3, 4, $500,000 Bitcoin…”

The data points to a remarkable supply-demand imbalance. Strategy's 553,555 BTC holdings, combined with potential government purchases of 1M BTC, could lock up 10% of total supply. When you factor in that 40% of Bitcoin's active supply and Ark's revised price targets now range from $500K to $2.4M by 2030, we're looking at a market that will redefine asset scarcity. The key question isn't if a supply shock will occur, but rather how dramatic it will be when multiple deep-pocketed entities compete for an increasingly limited pool of available Bitcoin.